Loans

Thank you for choosing Telco Plus Credit Union for your lending needs. Our award-winning loan programs have been recognized by Locals Love Us and Best of East Texas-Longview News Journal. Stop in today to experience our great customer service and learn more about our low rates!

The Loan Department at Telco Plus Credit Union offers:

- Auto Loans

- Personal Loans

- Credit Cards

- Credit Builder Loans

- Various other loan products

For specific questions and more information, contact our Loan Department. You can apply for a loan if you are not a member. It’s easy to become a member of Telco Plus Credit Union! To find out if you’re eligible for membership, please follow this link or give us a call.

We are now offering a new option for loan payments! You can use your checking account or debit card from other financial institutions to make payments. All you need is the Telco Plus Mobile App. Once you’re logged in, use the Transfer tab to make your payment. You can easily store your payment method, so you don’t have to reenter your information each month. If you have any questions, please contact Member Services!

Auto

Finance or refinance your car with Telco Plus Credit Union to save hundreds of dollars in monthly payments! We have some of the lowest car loan interest rates on new and used cars in Longview and Tyler, Texas! We package our low rates with low-priced automotive protection, extended warranties, and GAP insurance so that we can offer the best car loan deal for you.

- Online Applications*

- Electronic Signatures

- Skip A Pay*

- Nonmembers can apply before joining.

- Quick Approval

- Car shopping and trade-in advice

- Auto Shopping Tool - AutoSmart is an online shopping tool that can help you during the auto buying process. You can search local inventory, compare new autos side-by-side, calculate payments, look up trade-in values, and apply for a loan.

- Loan Terms 36 months – 84 months*

Our Telco Plus loan officers are here to help and make the auto loan process easy and convenient for you. To start saving money on your car loan, talk to one of our knowledgeable loan officers today!

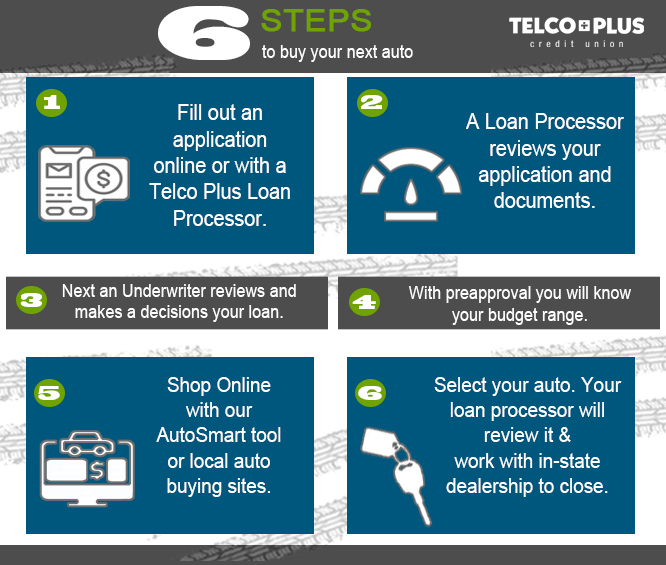

Auto Loan Process

Auto Refinancing

Refinance your car loan no matter when you purchased your car. Telco Plus Credit Union will refinance auto loans from other banks and credit unions, down to our lowest current rate. Most of the time our members save more than 2 or 3 points because our pricing is lower than other financial institutions. Find out how you can save money by talking to a loan officer today!

Bad Credit Auto Loans

At Telco Plus Credit Union, you are more than just a credit score. When considering your auto loan application, we look at your entire credit history, the car you’re financing, and many other factors so that we can help you with your loan approval.

We also offer free credit counseling and suggestions to help you improve your credit score. Reach out to our loan officers to discuss your options!

Interest Rate Improvement Guarantee

Our guarantee to Telco Plus Credit Union members is that you can reevaluate any car loan after 12 months to see if you qualify for a lower interest rate. Credit scores often dramatically improve after 12 months of good payment history which could put you in a lower interest rate category. You must ask for a re-evaluation. Only one request per 12 months, only one rate change per loan.

Credit Builder Loans

- Secured installment loans

- Secured credit cards

- Free credit counseling

Secured installment loans and secured credit cards require a deposit and are reported to all three credit bureaus. Our free credit counseling is recommended by our local Better Business Bureau. Call us today to set up an appointment with a loan officer to discuss your credit situation and what steps you can take.

Credit Builder Certificate Deposit Loan

This type of loan is like a savings account that you make payments towards and that reports to all three credit bureaus each month. A Credit Builder Loan is set up for $1,000 and you make scheduled monthly payments each month for 18 months.

- Start with $55 in your certificate of deposit

- Each month there is a scheduled due date

- Monthly payments must be made on or before the scheduled date

- The monthly payments are approximately $60 (amount is based on CD rate when CD is opened)

- You will build a good line of credit and have $1000 in your account

The key to building credit is not maxing out your spending limit. We recommend that you keep your monthly credit card charges around 30-35% of your spending limit. It’s a good idea to pay your balance each month so that you don’t have to pay a finance charge. The payment history reports to the credit bureau(s).

ITIN Loans

Telco Plus Credit Union provides loans with Individual Taxpayer Identification Numbers (ITINs). Building credit can be challenging in a new country which is why we offer secured credit cards and secured loans to people with ITINs. Ask a Loan Officer at Telco Plus Credit Union for more information!

Credit Cards

- EMV technology

- View, pay, and manage your account online

- No annual fee

- Secured and unsecured variable rates based on Prime Rate.

- 25-day grace period

- No transaction fee on cash advances from your credit union (interest accrues from the day of the advance)

- Free travel and accident insurance

- Optional life and disability insurance available at low rates

- To open: $500 minimum

- Spending limit: $400

The key to building credit is not maxing out your spending limit. We recommend that you keep your monthly credit card charges around 30-35% of your spending limit. It’s a good idea to pay your balance each month so that you don’t have to pay a finance charge. The payment history reports to the credit bureau(s).

Cost of Credit. You will pay a FINANCE CHARGE for all advances made against your Account. FINANCE CHARGES for cash advances and balance transfers begin to accrue on the date of the advance. New purchases will not incur a FINANCE CHARGE on the date they are posted to your Account if you have paid the Account in full by the Payment Due Date shown on your previous monthly statement, or if there was no previous balance. The applicable periodic rate used to compute the FINANCE CHARGE is based on the Prime Rate as published in the Money Rates section of The Wall Street Journal. Any change in the Prime Rate will be effective on the first day of the 2nd billing cycle following the date of the change. An increase in the Prime Rate will result in an increase in the periodic rate, which in turn, may result in higher payments. The ANNUAL PERCENTAGE RATE for any given billing cycle will be the Prime Rate plus 6.74%. In any event, the daily periodic rate (and the corresponding ANNUAL PERCENTAGE RATE) shall never be greater than 18%., or lower than 6.74%.

personal loans

- Low interest rates

- Fast Processing

- Convenient Repayment Terms

*Your rate, term, loan amount, and payments will vary based on creditworthiness and loan underwriting guidelines. Loan terms range from 6 months to 72 months; interest rates range from 6.75% APR to 17.25% APR. Please visit our loan rate page for other rates. Our personal loans do not have fees, only the Quick Cash loan has an application fee, see below for those terms and conditions. Loan interest begins to accrue on the open date of the loan. Delaying the first payment for 30 days or more increases the amount of interest paid over the term of the loan.

Loan Examples: A 12-month $1,000 loan with the best credit may have a low rate of 6.75% APR; and a payment of $87. Total loan payments will be $1,036.74; $1,000 paid towards the principal borrowed and $36.74 to interest. A 12-month $1,000 loan with less than perfect credit may have a rate as high as 17.25% APR; and a payment of $92. Total loan payments will be $1,095.28; $1,000 paid towards the principal borrowed and $95.28 to interest.

Quick Cash & Save

Quick Cash & Save loans by Telco Plus Credit Union are designed to replace loans from payday lenders. These personal loans:

- Don’t require a credit check.

- Have lower fees.

- Have lower interest rates.

- Help you build a savings account.

- 90 Days minimum membership at Telco Plus Credit Union

- 90 Days minimum time receiving direct deposit to Telco Plus Credit Union

- 6 Months minimum length of employment

- $1,000 minimum monthly gross income

- 18+ years old

- $20 nonrefundable application fee

- 2 recent pay stubs with application

- Negative share balances excluding courtesy pay

- More than 30-days delinquent on loans in the last 12 months

- Charge-off loans or share balances

- Unpaid loss to the credit union

Teacher Loans

- 0% APR (Annual Percentage Rate)

- Available year-round

- Credit and membership qualifications apply.

- Offer subject to change without notice.

- One loan per member at a time.

- Automatic payment and employment verification are required.

- Some other restrictions may apply.

Recreational Vehicle Loans

- Street-legal motorcycles

- Boats

- Personal watercraft

- ATVs

- Motor homes & Campers

- Tractors & Lawn Mowers

Student Loans

Whether you’re an undergraduate, graduate student, or parent, you could get money for school from Sallie Mae® Student loans in partnership with Telco Plus Credit Union. Sallie Mae® higher education loans are designed for the needs of undergraduates, graduate students, and parents.

- Competitive interest rates

- Multiple in-school repayment options

- Multiple repayment options

- No origination fees; no prepayment penalty

- Smart Option Student Loan® for Undergraduate Students

- Parent Loan

- Graduate loan suite is designed to meet the needs of students in specific fields of study

Borrow Responsibly

To make your student loan experience as simple and easy as possible, we encourage students and families to start with savings, grants, scholarships, and federal student loans to pay for college. Make sure to evaluate all anticipated monthly loan payments, and how much the student expects to earn in the future, before considering a private student loan. These loans are made by Sallie Mae Bank or a lender partner. Telco Plus Credit Union is not the creditor for these loans and is compensated by Sallie Mae for the referral of loan customers.

- For students attending participating degree-granting schools.

- For undergraduates only

- Graduate Certificate/Continuing Education coursework is not eligible for MBA, Medical, Dental, and Law School Loans

- Borrowers must be U.S. citizens or U.S. permanent residents if the school is located outside of the United States

- Non-U.S. citizen borrowers who reside in the U.S. are eligible with a creditworthy cosigner (who must be a U.S. citizen or U.S. permanent resident) and are required to provide an unexpired government-issued photo ID to verify identity.

- Applications are subject to a requested minimum loan amount of $1,000.

- Current credit and other eligibility criteria apply.

Parent Loan

- For borrowers with students attending participating degree-granting schools

- The student is not eligible to be a borrower or cosigner

- The borrower, cosigner, and student must be U.S. citizens or U.S. permanent residents

- The school may refund loan funds directly to the student, and if that occurs, borrower, and cosigner (if applicable) would still be responsible for repaying that amount

- Applications are subject to a requested minimum loan amount of $1,000. Current credit and other eligibility criteria apply

Although we do not charge you a penalty or fee if you prepay your loan, any prepayment will be applied as provided in your promissory note: First to Unpaid Fees and costs, then to Unpaid Interest, and then to Current Principal.

Sallie mae reserves the right to modify or discontinue products, services, and benefits at any time without notice. © 2019 Sallie Mae Bank. All rights reserved. Sallie Mae, the Sallie Mae logo, and other Sallie Mae names and logos are service marks or registered service marks of Sallie Mae Bank. All other names and logos used are the trademarks or service marks of their respective owners. SLM Corporation and its subsidiaries, including Sallie Mae Bank, are not sponsored by or agencies of the United States of America.

Loan Application

To apply for a loan or a VISA credit card with Telco Plus Credit Union simply click on the application button below.

Please complete the form with all the requested information. You’ll have up to 10 days to complete the form after you begin. After you complete the application, a Financial Services Representative will contact you within 4 hours during normal business hours, or the next business day if you finish after hours. All loans are subject to Telco Plus Lending Policies and Credit Approval.

If you have questions about the application process please feel free to call us at 903-753-5588. Business hours are Monday – Wednesday between 9:00 a.m. & 5:30 p.m. (CT) Thursday – Friday between 9:00 a.m. & 6:00 p.m.

- Individual Credit – only one borrower is responsible for repaying this loan.

- Joint Credit – more than one person (a borrower and co-borrowers) is responsible for repaying the loan.

- Married Applicants – may apply for a separate account.

After you finish your online application, please start collecting the following documents to support your application:

Auto Purchase

- Last 2 Paystubs

- Vin Number

- Self Employed, 2 yrs of tax returns & 3-6 months of FULL bank statements

- Buyers Order

- Exact Mileage

Auto Refinance

- Contract or document with current rate (if available)

- Last 2 Paystubs

- Vin Number

- Self Employed, 2 yrs of tax returns & 3-6 months of FULL bank statements

- 10 day pay off

- Exact Mileage

- Auto Insurance Card

Personal Loan

- Last 2 Paystubs

- Self Employed, 2 yrs of tax returns & 3-6 months of FULL bank statements

Quick Cash

- Last 2 Paystubs

To protect both you and the credit union, all collateral loans must maintain valid insurance coverage until they are paid off. Our partner company will send a letter on our behalf requesting that you upload your insurance information. If you don’t respond, they will follow up with an additional letter, followed by an email and a text message. If you still don’t respond, they will secure insurance coverage on your behalf.

Please note: the insurance they secure is more expensive than standard full coverage and only covers damage to the collateral! The cost of this insurance will be added to your loan payment, so we encourage you to respond promptly to avoid these additional charges.

If you don’t have insurance, please call CUFG Insurance for an insurance quote that will protect you and your collateral! Call 903-741-8741 for a free quote. They can help you find affordable insurance that protects you and your collateral.

Common mistakes include uploading insurance cards instead of the required declarations page, failing to list us as the lien holder, or having a high deductible.

The vendor’s communication includes contact information and Spanish translations for your convenience. If you have any questions, please reach out to your loan officer immediately.

Products

We value our members and appreciate that you borrow with us. We offer products designed to protect you.

Automotive Protection

Protect your car and yourself with protection services from Telco Plus Credit Union. Our options are cheaper than similar services at most dealerships and we offer more perks.

Extended Warranty

- Roadside services

- Pays the mechanic directly

- Covers tire replacement

- Four different price tiers

- Can be purchased at any time

- Automobile does not need to be financed with Telco Plus or anyone else

GAP

- Gap Plus Coverage

Don’t be left paying for an asset you no longer own! GAP PLUS Coverage by Telco Plus helps cover the cost between what is financed and the current market rate of your automobile in case of an accident. Additionally, if you finance a replacement vehicle with us within 90 days, GAP PLUS can reduce your loan balance by $1,000. Please ask a Loan Officer if this coverage would be good for you.

Payment Protection

- Accidents

- Disability because of injury or illness

- Hospitalization

- Unexpected death

- Medical leave

- Involuntary unemployment

- And more

Your purchase of Debt Protection with Life Plus is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions, and exclusions may apply.

*Please contact your loan representative or refer to the Member Agreement for a full explanation of the terms of Debt Protection with Life Plus. You may cancel the protection at any time. If you cancel protection within 30 days, you will receive a full refund of any fee paid.

DP-1467002.1-0416-0518 ©2017 CUNA Mutual Group, All Rights Reserved.

Skip-a-Pay

If you take out a loan from Telco Plus Credit Union, you might be eligible for our Skip-a-Pay option. This is perfect for Christmas, going on vacation, and back-to-school costs.

- Two per year

- Applications must be received at least 4 days prior to payment due date

- Loans that don’t apply: Real Estate, Home Equity, Mortgage, Certificate Secured, Quick Cash-n-Save, Lines of Credit, Credit Card, any loan under 6 months of payment history

- Other restrictions may apply

- $30 Skip-a-Pay fee

- Please see a loan officer for full restrictions

Loan Rates

| Loan Type | APR* |

| Autos (New & Used 2020 and newer) |

as low as

4.74%**

|

| Used Autos (2020 and older) |

as low as

4.99%

|

| Motorcycles (New & Used 2021 and newer) |

as low as

4.99%

|

| Boats, Motor Homes, and Campers (2021 and newer) |

as low as

5.59%

|

| Jet Skis, Personal Watercrafts, and ATV (2021 and newer) |

as low as

4.99%

|

| Other Secured |

as low as

6.29%

|

| Personal Loans |

as low as

8.24%

|

| VISA® (currently) |

as low as

14.49%

|

All Loan Rates are subject to Change. Membership in Telco Plus Credit Union is required for all credit union services. Rates apply to qualifying members. Qualifications for loans are based in part on information received from all three Credit Reporting Agencies.

| Fee Description | Amount |

|---|---|

| Late Payments |

5% of loan payment

|

| Skip-a-Pay |

$30

|

| ProPay Online Payment |

–

|

| Debit Card |

$5.95

|

| Checking |

$1.95

|

| Quick Cash |

$20

|

| Cash Advance |

$0

|